California Bankruptcy Lawyers

Since 1998, the law firm of Borowitz & Clark has helped over 40,000 people in Los Angeles and Southern California get out of debt. Contact us today to discuss a brighter financial future. For your convenience we offer free 100% virtual consultations. Led by two attorneys who are both Board Certified in Consumer Bankruptcy by the American Board of Certification.

Our Bankruptcy Services

Chapter 7 Bankruptcy

We have years of experienced and have filed tens of thousands of Chapter 7 cases. We know the courts, the judges, and the creditors. We can help you protect your important property and wipe your financial slate clean. Get a fresh start today.

Chapter 13 Bankruptcy

We will help you decide how best to protect your most important assets and will stand up to creditors who threaten your rights. Under Chapter 13, you will pay most of your attorney’s fees through your plan, so you’ll have the benefit of an experienced bankruptcy lawyer without having to come up with an upfront payment.

Debt Negotiation

Attorneys at Borowitz & Clark have years of experience in helping clients deal with overwhelming debt. We’re not just bankruptcy attorneys – we’re legal financial experts!

Our partners have gained national recognition for their work in helping Californians rebuild their financial lives

How it Works

The Law Office of Borowitz & Clark

Step 1

Schedule a virtual consultation

Scheduling a consultation is easy; we can be reached via email, phone, or chat. All initial consultations are free of charge.

Step 2

Discuss your financial situation with an expert

During your consultation, you’ll speak with one of our expert attorneys, not a paralegal or call center.

Step 3

Review all of your financial options

We are bankruptcy attorneys, but bankruptcy isn’t the answer for everyone. We’ll explain every option you have available.

Step 4

Create a debt relief

plan

We’ll work together to put together a plan to get back on your feet. Our team will help with a budget, creditors, and more.

Meet Our Founding Bankruptcy Attorneys

There is nothing more stressful than finding yourself deep in debt. California law offers a number of debt relief solutions, but it’s important to engage experienced legal counsel to help navigate what can be a very complex process. Our founding partners are both Board certified consumer bankruptcy specialists who have helped thousands of people through difficult times.

Barry Borowitz

Founding Partner, Borowitz& Clark, LLP

Mr. Borowitz is board certified in Consumer Bankruptcy by the American Board of Certification and has been practicing bankruptcy law exclusively for almost 30 years.

Erik Clark

Founding Partner, Borowitz& Clark, LLP

Mr. Clark is Board Certified in Consumer Bankruptcy by the American Board of Certification and a member of the State Bar in California, New York, and Connecticut.

Law Offices Serving All of Southern California

Our attorneys have extensive experience practicing in the Federal Bankruptcy Courts in the Central District of California, the District that encompasses Los Angeles, Orange, San Bernadino, Riverside, and Ventura counties. In fact, Borowitz & Clark attorneys were an instrumental part of the team that reworked the Chapter 13 Bankruptcy Plan form in 2017 to comply with the new national rules that went into effect on December 1, 2017.

California Bankruptcy Representation

Skip the traffic and time away from work. While we maintain traditional brick and mortar offices, Borowitz & Clark offers the convenience of virtual bankruptcy representation. Work with our firm from the comfort of your home.

One Of The Leading Bankruptcy Law Firms In The State of California

Our firm is proud to have received extensive awards and recognition. In addition to our Board Certification in bankruptcy law, we are proud members of the Law Firm Anti-Racism Alliance, have been named one of the Best Bankruptcy Law Firms in Los Angeles for 2021, have been named Super Lawyers, and are leaders in the National Association of Consumer Bankruptcy Attorneys (NACBA), among other bankruptcy specific organizations.

What Our Clients Say

“Thanks so much for all your help and assistance in getting us through our tough times. Your prompt response and eager to help has been of great value to us. We could not have asked for a better person to help us with our case.”

– Duc T., Los Angeles

“This law office exceeded my expectations! The support and competitive urgency by the staff is unmatched. They walked me thru the entire process. They made me feel good during an unpleasant time. Mr. Borowitz and Annette Gomez are amazing. I’m truly blessed to have had such great representation during my bankruptcy.”

– Omar P., Rowland Heights, CA

“You and the office staff have been incredible!! Can’t thank you enough for making a nightmare financial situation into a smooth do over and clean starts. Many many blessing to you, Erik, Carmen, Debra (Debbie) and everyone involved for calming our every melt down.”

– M & L, California

“If not for you guys, I have no idea where I would be, probably would have lost the house, car, just everything, you guys gave me my life back and I promise hands down I will never be in that situation again, thank you all so very much.”

– B.S. Van Nuys, CA

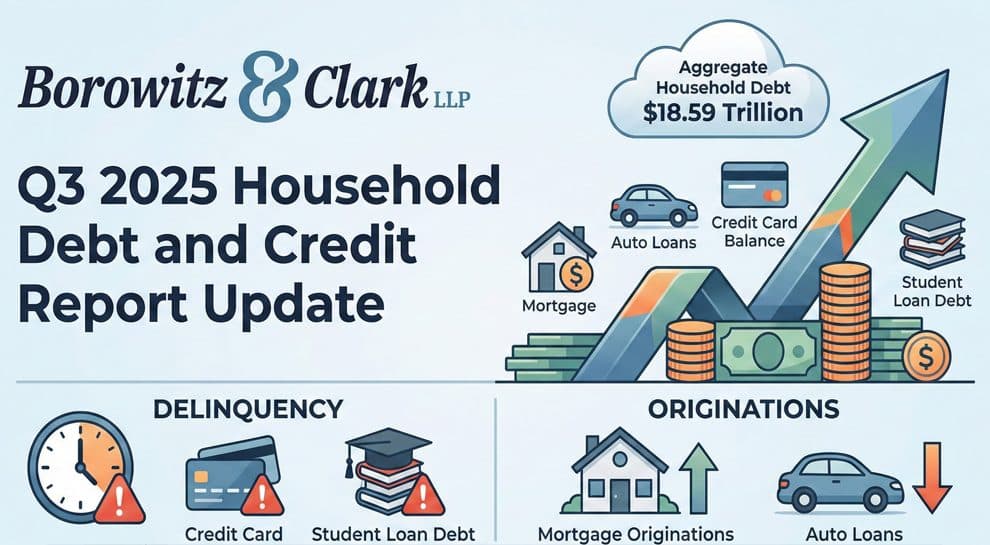

$750,000,000+ in debts discharged for our clients

We’ve helped over 40,000 families across Southern California find a financial fresh start.

Serving Southern California residents

Borowitz & Clark has been headquartered in West Covina, California for over 20 years.

Bankruptcy Law Professors at Loyola Law School 2010-18

We don’t only know bankruptcy law and debt relief; we’ve taught it too.

The Borowitz & Clark Difference

When you hire Borowitz & Clark, you aren’t just hiring attorneys; you are hiring the experts who once taught other lawyers how to practice bankruptcy law.

We Grade the Most Common Bankruptcy Myths: Pass or Fail?

Myth “I will lose everything I own, including my home and car.”

The Professor’s Correction: False

In California, the vast majority of Chapter 7 filings are “no-asset” cases, meaning you keep everything. We utilize California’s generous System 1 and System 2 exemptions to protect your home equity, vehicle, and retirement accounts. You don’t file bankruptcy to lose your property; you file to protect it.

Myth “My credit score will be ruined forever.”

The Professor’s Correction: False

Your credit is likely already damaged by missed payments and high utilization. Bankruptcy acts as a “stop” to the damage. Most of our clients see their credit scores rebound to the 700 range within 12 to 24 months after discharge, provided they follow our post-bankruptcy rebuilding steps.

Myth “I make too much money to file for bankruptcy.”

The Professor’s Correction: False

Many high-income earners believe they are disqualified by the Means Test. However, this test is complex and allows for deductions like mortgage payments and taxes. Even if you don’t qualify for Chapter 7, Chapter 13 allows you to consolidate debts into an interest-free repayment plan that fits your budget.

Myth “Everyone will know I filed.”

The Professor’s Correction: False

While bankruptcy is technically a matter of public record, it is not published in local newspapers or broadcasted. Unless you are a celebrity or a major corporation, the only people who will know are your creditors and the people you choose to tell.

Myth “I can’t discharge tax debt.”

The Professor’s Correction: It Depends

This is a common misunderstanding. Income tax debt can often be discharged if it meets specific criteria (e.g., the debt is at least 3 years old and returns were filed on time). We analyze your tax history specifically to see if you qualify for this relief.

Recent Articles

Get a Free Debt Evaluation