Two surveys conducted this spring and summer show that people in California are feeling the pinch from rising costs.

Published

Here’s a look at what’s driving the surge in repossession and auto loan delinquencies and what likely lies ahead.

Published

In California, departures far outnumber arrivals. Here's where Californians are heading, and why it is they're leaving in the first place.

Published

An error on your credit report can mean higher interest rates, denial of credit, and worse. Here's what you can do to protect yourself.

Published

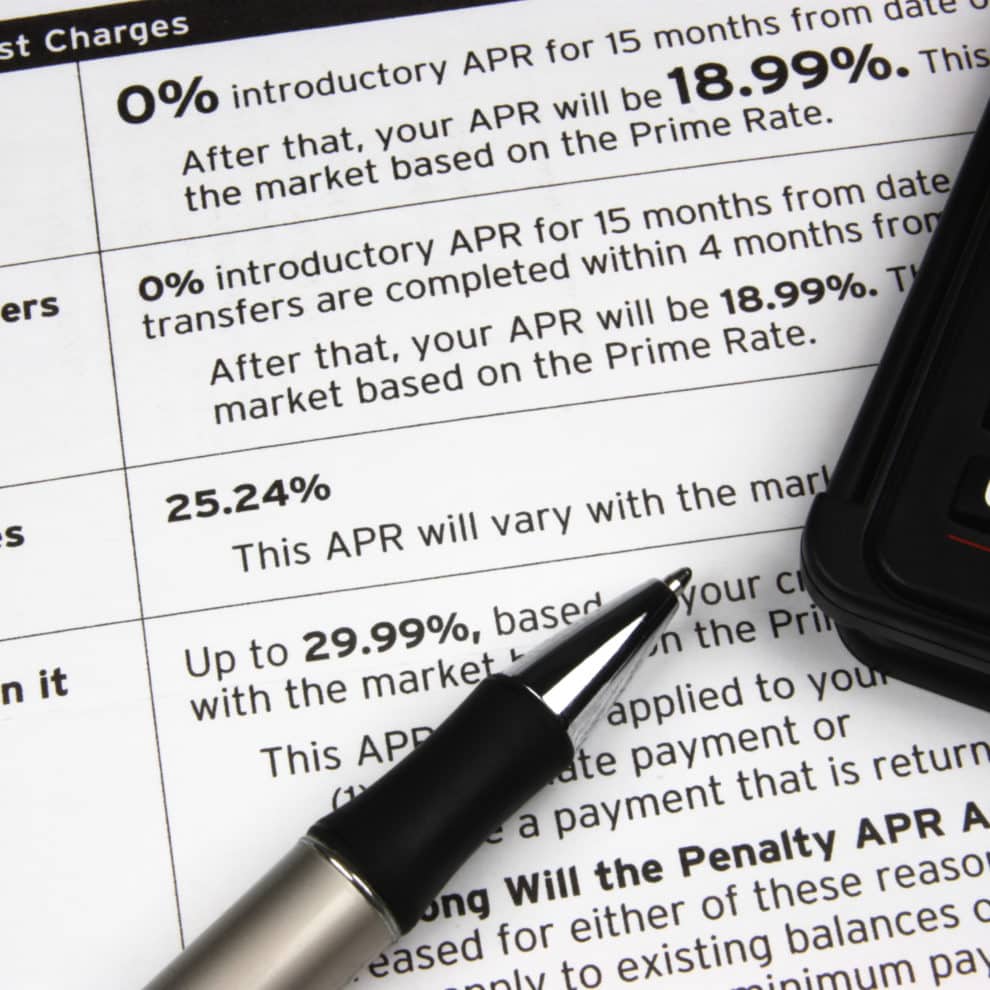

Many don’t realize that interest rates on your existing credit card account may also jump when the Federal Reserve raises rates.

Published

With the price of gas, groceries, and other essentials high, people in Los Angeles and around the country are making changes.

Published

In a community property state like California, the law doesn’t always recognize divisions of assets. Here's what you should understand.

Published

Surrendering property in bankruptcy can be a choice, and a powerful tool for getting out from under high-cost debt and starting fresh.

Published