We all know we should be creating a budget and sticking to it, but it’s not always easy. That’s especially true during times of high inflation or fluctuating costs like the past few years. It’s easy to get discouraged and lose track of your plan entirely when your budget needs revision or an unexpected expense crops up. Here are a few tips to make staying on budget a little easier.

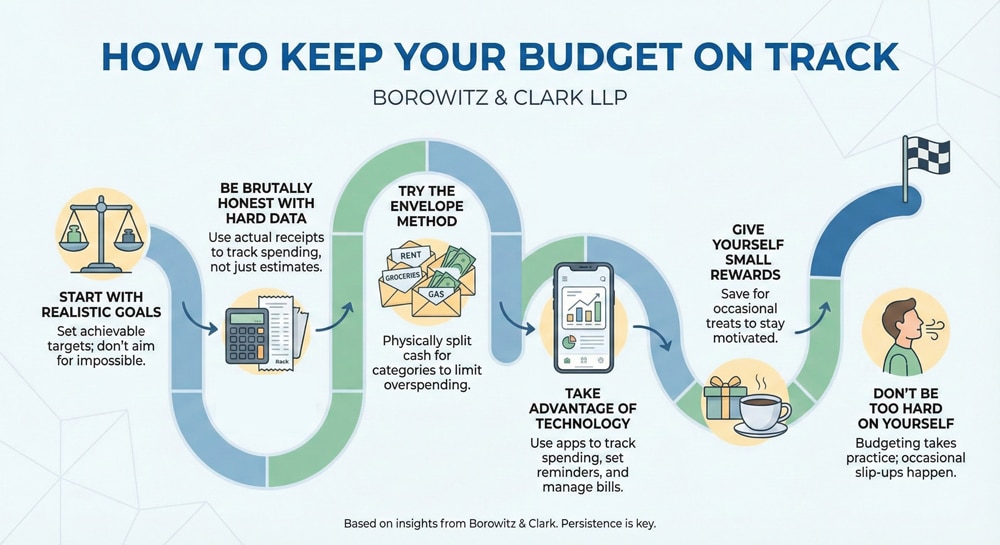

1. Start With Realistic Goals

It’s easy to get overly ambitious when you’re building your budget, but you’ll never be able to stick with it if you start with impossible goals. The first step is to be brutally honest about what income you can count on and what you’re going to spend. Start with the expenses that you can’t change, like rent and car payments. Then, take the rest of your income and figure out where you’ll need to spend it. Use hard data. In 2025, there are many apps that break down your expenses into categories–that option may even be built into your credit card statements or online banking records.

One key to staying on budget is building emergency savings to help cover unexpected costs like a medical bill or car repair. In the past few years, the long-time suggestion that you try to save 10% of your income has been updated and many experts now suggest aiming for 20%. That’s great, if you can make it work. But if you can’t, figure out what you can do consistently. Even if it’s small, it will add up over time.

When you fall short, you have to be just as realistic about what you plan to cut out as you are about the rest of your budget. Can you really cut your grocery bill in half? Probably not. But you probably can cut the amount you spend eating out.

2. Don’t Give Yourself the Chance to Cheat

A realistic budget is better than an unrealistic one, but it’s still not always easy to follow. One way to help yourself stay on track is to simply take the money out of your own hands. One possibility is to separate the funds you have budgeted for your monthly bills into a separate account that you don’t take money out of for anything else. You can also set up automatic withdrawals for your bills so the money goes straight to cover those expenses and you never have a chance to spend it. You can also set up automatic withdrawals to a savings account or split your direct deposit between your checking account and savings account, which may make it easier to build your savings.

3. Take Advantage of Technology

Technology is your friend when it comes to building your budget and tracking your expenses. Many are free or very low-cost. For example, you’ll find many tools, including free digital budgeting “worksheets” at MyMoney.gov.

4. Give Yourself Rewards

It would be great to make enough money to not have to create a strict budget, but most of us don’t have that luxury. But following that strict budget means you’re constantly paying attention to everything you spend and may mean that you’re giving up things you love. And if you do that all the time without a break, you may end up splurging and going over.

Instead, try to find a way to put a few bucks away every month. It doesn’t have to be a lot – even just $5 or $10 a month. When you have enough, you can use it for something special – a fancy dinner or a night on the town or a day at the spa. Having that little treat to work toward can make sticking to the rest of your budget a whole lot easier. It gives you something to look forward to as a reward for all your hard work and discipline!

5. Don’t Be Too Hard on Yourself

No matter how dedicated you are to your budget, outside factors can still throw you off. Even without a big event like job loss, a few sick days or a flat tire before your emergency fund is in place can mean juggling. Do your honest best and course-correct when necessary.

6. Your Budget Will Change Over Time

Creating a budget can be a lot of work, so you probably don’t look forward to making revisions. Still, your income and expenses won’t stay constant. You’ll need to revisit your budget if your income changes, your rent increases, or perhaps even if the cost of gasoline or some other regular expense increases significantly.

You’ll also need to revisit your budget if you find yourself regularly going over budget or unable to pay something. Being on alert and honest with yourself is half the battle.

When Budgeting Fails

Building a realistic budget is your best first step, and can solve a lot of problems. But, it doesn’t solve every financial problem. If you try to create a budget and discover that you’re consistently bringing in less than you’re spending, you have two choices: increase your income or cut expenses. If the costs breaking the budget are things like medical bills, high credit payments and other unsecured debts, it may be time to talk to an experienced Los Angeles bankruptcy lawyer.